Conveyor Roller HS Code 843139

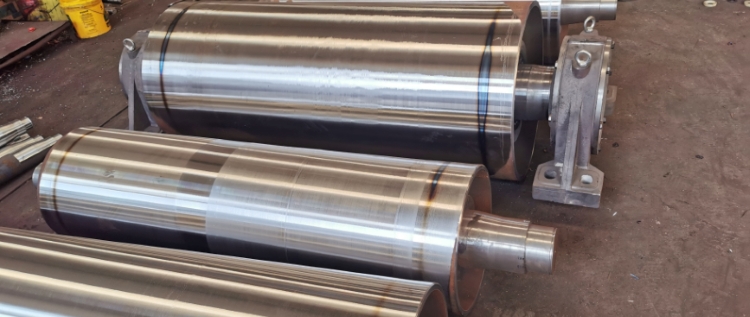

Harmonized System (HS) codes are a standardized numerical method of classifying traded products, used by customs authorities around the world to assess tariffs and control the movement of goods across borders. These codes are essential for international trade, facilitating the easy categorization and taxation of goods. An example of a specific item classified under these codes is the conveyor roller hs code, which categorizes rollers mainly used in conveyor systems. Conveyor rollers are critical components in the manufacturing and distribution sectors, where they support the automated movement of goods. They are extensively used in industries such as mining, food production, and logistics, playing a pivotal role in the efficient handling and processing of materials. The precise classification of these rollers through their HS code helps in streamlining trade procedures and ensuring compliance with international trading standards.

General Overview of Conveyor Roller HS Codes

The conveyor roller hs code is a specific category within the Harmonized System (HS) of tariff nomenclature used internationally for the classification of goods transported across international borders. This code helps in identifying the materials and components specific to conveyor rollers, which are crucial components in various material handling systems, allowing the facilitated movement of goods and materials on a rolling surface.

What Does the Conveyor Roller HS Code Encompass?

The hs code for conveyor roller typically encompasses various types of rollers designed to be integrated into conveyor systems. These include but are not limited to:

- Steel rollers

- Plastic rollers

- Rubber-coated rollers

- Impact and return rollers

Each type of roller is classified based on its material composition, size, design, and specific use within a conveyor belt system. The HS code for these items will vary slightly depending on these factors but generally falls under a specific section that caters to conveyor parts and accessories.

Importance of HS Codes for Conveyor Rollers

The use of the conveyor roller hs code is pivotal in facilitating international trade and customs operations for several reasons:

- Standardization and Compliance: HS codes provide a universally recognized language for categorizing goods, which simplifies the process of importing or exporting conveyor rollers across international borders. This standardization ensures that all parties involved (manufacturers, customs officials, traders) are on the same page regarding the product specifications and requirements.

- Tariff Determination: By classifying conveyor rollers under specific HS codes, it becomes easier for customs officials to determine the applicable tariffs or taxes that should be imposed on these goods. This helps in assessing the correct duty that an importer needs to pay, thus streamlining the financial transactions involved in international trade.

- Trade Statistics: HS codes enable governments and international bodies to keep accurate and comprehensive statistics of trade data. Knowing the quantity and type of conveyor rollers traded internationally helps in economic planning, market analysis, and the enforcement of trade laws.

- Regulatory Compliance: Using the correct roller conveyor hs code helps businesses ensure compliance with local and international regulations pertaining to safety, quality, and environmental impact. This compliance is critical for avoiding legal issues and facilitating smooth operational practices.

- Efficiency in Customs Operations: Proper use of HS codes accelerates the process of goods clearance at borders. With predefined codes, customs officials can quickly process entries and releases, reducing the time goods spend in transit or at checkpoints.

- Market Tracking: For businesses, understanding the patterns of trade through HS codes helps in tracking market trends, demands, and supply scenarios. This data is crucial for strategic planning and for maintaining competitiveness in the global market.

- Protection of Domestic Industries: HS codes are also used to enforce various protective measures such as anti-dumping duties. For conveyor rollers, these codes help ensure that international trade does not harm domestic manufacturers by allowing unfair competition.

- Facilitation of International Agreements: Many international trade agreements involve product-specific details that are easily managed through HS code classifications. These agreements can ensure reduced tariffs and better market access for conveyor rollers, promoting international business.

The conveyor roller hs code is more than just a classification for customs; it is an essential tool for international trade, providing benefits ranging from regulatory compliance to economic analysis. Proper understanding and utilization of these codes are crucial for businesses involved in the manufacturing and distribution of conveyor systems.

Detailed Look at Specific Conveyor Roller HS Codes

This section provides a granular analysis of various conveyor roller hs code classifications, including general global codes and more specific ones used in particular countries like India. It also delves into HS codes related to different types of conveyor rollers, including gravity, steel, and belt conveyors that utilize rollers.

HS Code for General Conveyor Rollers

Conveyor Roller HS Code: General Overview

The general roller conveyor hs code used globally is 843139. Roller Conveyor HS Code for Export,8479, Machines And Mechanical Appliances Having Individual Functions, Not Specified Or IncludedThis. HS code specifically covers parts of conveyors, including rollers which are integral to the systems’ operation. These components can vary extensively based on their design and the materials used for manufacturing, such as metal, plastic, or rubber.

843139: This code is crucial because it encompasses all non-specific, generic conveyor parts and accessories, making it widely applicable in various industries worldwide. It is used predominantly for rollers that do not fit into more specialized categories described below.

Get custom conveyor roller solutions. Contact us for more info!

Country-Specific Codes

Conveyor Roller HS Code Zauba

Zauba is a platform that tracks India’s import and export data, providing specific HS codes for a myriad of products, including conveyor rollers. The hs code for conveyor roller used in Zauba for tracking these items generally revolves around the same global HS code but tailored to specific types under Indian customs laws.

Conveyor Roller HS Code in Zauba: Typically, the HS code used is 84313910. This code is designated for rollers used in conveyors, which are not motorized. The specificity of the code helps in identifying trade volumes, duties, and compliance regulations more accurately.

Conveyor Roller HS Code India

In India, different types of conveyor rollers are classified under various HS codes depending on their construction and material:

84313910: For general use conveyor rollers.

84313920: For motorized conveyor rollers.

84313930: For specially designed rollers used in manufacturing industries like steel, automotive, etc.

Types of Conveyor Rollers and Their HS Codes

Gravity Roller Conveyor HS Code

Gravity roller conveyors, which use the force of gravity to move items across the rolling surface, are classified under HS code 84283900. This specific code is used mainly for conveyors that operate without an external power source or motor, typically used in warehousing and assembly operations.

84283900: Applicable to fixed or expandable roller conveyors that utilize gravity for movement.

HS Code for Steel Roller Conveyor

Steel roller conveyors, known for their strength and durability, are categorized under 84282011. This code is particularly used when the rollers are predominantly made from steel, which is common in heavy-duty applications.

84282011: Specifically used for conveyors where steel roller HS code are integral to the system, especially in environments that require corrosion resistance and robust material handling capabilities.

HS Code for Roller Conveyor Belt

Conveyor belts that incorporate rollers are assigned the HS code 40101900. This code covers those conveyor belts combined with rollers designed to ease the transport and handling of goods, particularly in bulk handling and process industries.

40101900: Used for conveyor belts with rollers which help in reducing the friction and energy requirements of the system, thereby enhancing efficiency and productivity.

Understanding the specific conveyor roller hs code is essential for compliance, efficient customs processing, and strategic trade operations. Each code not only helps in identifying the type of roller and its use but also in navigating the complex landscape of international trade regulations.

Conveyor Roller HS Code Configurations

In this section, we delve deeper into the conveyor roller hs code specifically tailored to various configurations and forms of roller conveyors. These details are crucial for accurately classifying roller conveyors for international trade, ensuring compliance with global trade regulations, and facilitating efficient customs processes.

Roller Conveyor HS Code for Export

Exporting conveyor rollers requires precise classification to meet international standards and regulations. The general HS code for exporting these items is 843139, which encompasses various parts of conveyors, including the rollers themselves. However, specific configurations might require more specific codes:

These codes are pivotal in determining tariffs, managing trade policies, and ensuring that the products meet the export criteria of the originating country and the import requirements of the destination country.

Roller Conveyor HS Code for Import

The HS (Harmonized System) Code is an international standardized system of names and numbers for classifying traded products, determining the Roller Conveyor HS Code for import is crucial. By identifying the correct HS Code for roller conveyors, importers can ensure compliance with customs regulations, accurately calculate tariffs and duties, and streamline the import process.

Conveyor Roller Parts HS Code

Each part of a conveyor roller can be classified under a specific HS code, depending on its type and function:

84313950: For rollers designed to be part of heavy-duty conveyors used in industries such as mining and construction.

84313990: For other miscellaneous parts and accessories of conveyors not specified elsewhere, including brackets, frames, and coupling units.

These specific codes help in segregating the parts during shipments and in inventory management for companies dealing with diverse types of conveyor systems.

HS Code for Conveyor Roller Assembly

When shipping roller conveyor as complete assembled units, they are generally classified under:

84283990: This code is used for conveyor systems that are fully assembled, which include the rollers, frames, supports, and potentially the motor, depending on the system’s configuration.

This HS code is crucial for companies that supply complete conveyor solutions rather than individual parts, facilitating easier and more streamlined customs clearance.

HS Code for Powered Roller Conveyor

Powered or motorized roller conveyors, which include rollers that are driven by motors, are classified distinctly to reflect their electrical componentry and functionality:

84282011: For conveyors where the rollers are powered using electric motors. This code covers the industrial application of powered roller conveyors especially used in manufacturing and processing industries.

84283300: For continuous-action elevators and conveyors for goods or materials, which are roller type and motorized.

These HS codes are essential for distinguishing between non-motorized and motorized systems, which helps in regulatory processes and in applying the correct tariffs and trade measures.

The precise conveyor roller hs code for various configurations plays a fundamental role in international trade. These codes not only define the product for customs purposes but also influence the logistics, tariffs, and overall trade compliance of roller conveyors. Understanding and using the correct HS codes ensures that conveyor roller shipments are processed smoothly and efficiently across borders, minimizing delays and avoiding potential fines or legal issues.

Navigating Conveyor Roller HS Codes Classification

Accurate classification of conveyor roller hs code is essential for compliance with international trade laws, securing the correct tariff rates, and minimizing the risk of costly delays in customs. This section provides detailed guidelines on how to correctly classify conveyor rollers, along with common pitfalls and how to avoid them.

Tips for Accurate HS Code Classification

- Understand the Basics:

Begin with a solid understanding of what an HS code is and the structure of the Harmonized System. Recognize that the first 6 digits are generally the same in all countries, while the subsequent digits may vary depending on local customs regulations. - Detailed Product Description:

Have a detailed and clear description of the conveyor roller, including its material composition, use, and any other features that distinguish it from similar goods. - Check the General Rules of Interpretation (GRI):

The GRIs are applied to determine the most specific classification possible. Start with GRI 1, which applies to titles and headings, and proceed to subsequent rules for more specific guidance. - Refer to Official Explanatory Notes:

Use the World Customs Organization’s explanatory notes for the HS as a reference. These notes provide clarity on the interpretation of specific codes and headings. - Consult Customs Rulings:

Look up past customs rulings to see how similar products have been classified. This can provide precedent and guidance for your products. - Use a Decision Matrix:

Create or use an existing matrix that helps decide the most appropriate HS code based on product features and characteristics. - Engage with HS Classification Experts:

When in doubt, consult with professionals who specialize in tariff and customs classifications to ensure accuracy. - Conveyor Belt Attendant Training Seminars:

Participate in workshops and seminars offered by trade organizations or customs authorities that focus on HS classification. - Stay Updated on Changes:

HS codes are updated every five years. Stay informed about changes that might affect your classifications. - Leverage Technology:

Utilize software solutions that help in classifying products according to HS codes. These can reduce human error and improve efficiency. - Document Your Decisions:

Keep a record of how you determined the HS code for your conveyor rollers, including any advice or rulings you consulted. - Review Regularly:

Periodically review your classifications to ensure they remain correct with current standards and practices.

Common Pitfalls in HS Code Classification and How to Avoid Them

- Overgeneralization:

Avoid using a general HS code if a more specific code applies. Overgeneralization can lead to incorrect duty calculations and potential fines. - Misinterpretation of Terms:

Understand definitions and terms as they are described in the HS manual, not in a colloquial or industry-specific context. - Ignoring Component Materials:

Do not overlook the materials of construction. Different materials might lead to different classifications (e.g., plastic vs. metal rollers). - Neglecting Product Changes:

Update classifications if the product design or material changes. What was accurate one year may not be the next. - Relying on Outdated Information:

Always use the most current HS code revision and customs rulings. Using outdated codes can lead to non-compliance. - Inconsistent Coding Among Products:

Ensure consistency in how you classify similar products. Inconsistencies can trigger audits or re-assessments by customs. - Failure to Consult Experts:

Do not hesitate to consult with customs officials or trade compliance experts when uncertain about the correct classification. - Lack of Documentation:

Maintain thorough documentation of how each HS code was determined. This documentation can be crucial in justifying your classifications during customs audits or legal challenges.

Navigating the conveyor roller hs code classification process efficiently requires attention to detail, a proactive approach to learning and adapting, and a thorough understanding of international trade regulations. By following these tips and being aware of common pitfalls, businesses can ensure compliance, minimize legal risks, and facilitate smoother customs processing.

Need top-quality conveyor rollers? Contact us for more details today!

Practical Implications of Conveyor Roller HS Codes in Trade

The conveyor roller hs code plays a crucial role not only in classification for customs but also significantly impacts the trade dynamics of conveyor rollers. This section explores the practical implications of HS codes in the conveyor roller trade, particularly focusing on compliance with international trade laws and the economic impact of these codes.

Import and Export Compliance

Correctly using the conveyor roller hs code is essential for complying with international trade laws. Accurate HS codes ensure that businesses can:

- Avoid Penalties: Inaccurate coding can lead to severe penalties, including fines and delays in customs. Correct HS codes prevent these issues by ensuring that all information is transparent and regulations are strictly followed.

- Facilitate Faster Customs Clearance: Products classified accurately and clearly can pass through customs more swiftly, reducing waiting times at borders and decreasing the costs associated with delayed shipments.

- Ensure Compliance with Trade Agreements: Many trade agreements require products to be classified according to the HS code. Proper classification is crucial to benefit from lowered tariffs and other trade facilitations offered under these agreements.

- Prevent Misclassification Issues: Misclassification can lead to products being detained at customs, which not only affects the delivery times but also impacts the supplier-customer relationship. Accurate classification using the correct roller conveyor hs code helps in maintaining good business practices and customer trust.

Steps to Ensure Compliance:

- Regular Training: Regular training sessions for the team responsible for classification can help avoid errors that lead to non-compliance.

- Use of Technology: Implementing software that automatically updates HS codes and assists in classification can reduce human errors significantly.

- Consultation with Experts: Regularly consulting with customs experts or legal advisors can help keep abreast of any changes in trade laws and classification standards.

Economic Impact

The hs code for conveyor roller significantly affects the economic aspects of international trade by influencing tariffs and taxes:

- Tariff Determination: The HS code is directly used to determine the tariff applicable to a product. For conveyor rollers, different HS codes might attract different tariff rates depending on the material or specific use of the roller. For example, rollers used in mining might have different tariffs compared to those used in agricultural conveyors.

- Impact on Taxes: Import taxes are also calculated based on the HS code. Accurate coding ensures that businesses are taxed correctly, avoiding overpayment or potential legal consequences of underpayment.

- Influence on Trade Barriers: HS codes can be used as tools for economic policy. Governments may adjust tariffs on certain HS codes to protect local industries or to retaliate in trade disputes. Understanding how conveyor roller hs codes are treated can help businesses anticipate and react to such changes.

- Facilitation or Deterrence of Trade: Simplified and lower tariff classifications can encourage international trade, while complex and high tariff classifications may deter it. Businesses need to strategically understand these classifications to manage their international supply chains effectively.

By understanding and correctly applying the conveyor roller hs code, companies can not only comply with legal standards but also optimize their economic outcomes. This involves strategic decisions regarding entry markets, supply chain logistics, and cost management, all of which are influenced by the implications of HS codes.

FAQs about Conveyor Roller HS Code

The Harmonized System (HS) code for conveyor roller parts is a specific identifier used globally for categorizing goods in international trade. Conveyor roller parts, vital components for the material handling industry, fall under various HS codes based on their specific types and materials. Generally, components such as frames, brackets, and individual rollers might be classified under a range of HS codes, including sections from 7301 to 7326 for iron or steel parts, or 8431, which specifically covers parts suitable for use solely or principally with machinery of headings 8425 to 8430. The categorization is critical for determining import duties, taxes, and regulations. Knowing the exact HS code for the conveyor roller parts you are dealing with is essential for compliance with international trade laws and for minimizing the risk of customs delays.

Rollers, depending on their specific applications and materials, are categorized under a variety of HS codes. For general rollers, which can include everything from industrial rollers used in manufacturing processes to simple rollers found in office chairs, the HS code can range widely. Industrial and machinery rollers often fall under 8483, which includes transmission shafts, bearings, and gearing parts. More specific HS Codes, like 8482.50 for tapered bearings, may apply if the rollers include bearings. The broad range of possible classifications makes it critical to understand the specific type of roller in question, including its material composition and primary use, to identify the correct HS code. This code determines not only the import and export considerations but also the compliance regulations in different countries.

In the context of India’s Goods and Services Tax (GST), the Harmonized System Nomenclature (HSN) codes serve as an extension of the international HS coding system to classify goods for taxation purposes. The HSN code for a conveyor roller stand, which supports the conveyor rollers, might vary based on its materials and design but is generally classified under 8428. This code is dedicated to lifting, handling, loading, or unloading machinery, including conveyors. The precise HSN code can affect the GST rate applied and is crucial for businesses to ascertain to ensure accurate tax filing and compliance with Indian taxation laws. Understanding the specific characteristics and uses of the conveyor roller stand is necessary to determine the most accurate HSN code under GST.

The HS code 8431.39 0010 is a highly specific classification within the Harmonized System, which is used globally to identify and categorize products in international trade. This code is particularly detailed, pointing to parts of machinery falling under heading 8431, which encompasses parts suitable for use solely or principally with the types of machinery classified from 8425 to 8430. These machineries include conveyors, elevators, moving equipment, and other similar apparatuses for handling materials. The suffix 39 0010 further narrows down the classification to a specific type or part of machinery, indicating a specialization that may have implications for regulatory, tariff, or statistical purposes in international trade. Businesses dealing with such specific parts need to be accurately informed of such codes to ensure compliance with trade regulations, correctly calculate tariffs, and facilitate smooth logistics and customs procedures.

The HSN (Harmonized System of Nomenclature) code for a roller conveyor system typically falls under Chapter 84, which covers machinery and mechanical appliances. Specifically, the code for roller conveyors is often categorized under subheading 8428, which pertains to “Other lifting, handling, loading or unloading machinery (for example, lifts, escalators, conveyors, teleferics).” Within this subheading, roller conveyors are commonly classified under 8428.39.00. This classification helps in identifying the product for taxation and import/export documentation purposes. It is crucial for businesses to use the correct HSN code to ensure compliance with international trade regulations and to avoid any legal issues or delays in customs clearance. Proper classification also aids in determining applicable taxes and duties, facilitating smoother and more cost-effective cross-border transactions.

The HS (Harmonized System) code for machine rollers is generally found under Chapter 84, which deals with machinery and mechanical appliances. Specifically, machine rollers are often categorized under subheading 8483, which pertains to “Transmission shafts (including cam shafts and crank shafts) and cranks; bearing housings and plain shaft bearings; gears and gearing; ball or roller screws; gear boxes and other speed changers, including torque converters; flywheels and pulleys (including pulley blocks); clutches and shaft couplings (including universal joints).” Within this subheading, machine rollers typically fall under the code 8483.90, which covers parts of the aforementioned items. Using the correct HS code is essential for compliance with customs regulations, accurate tariff calculations, and smooth import/export procedures. It ensures that the goods are appropriately classified, which is critical for avoiding legal complications and ensuring timely clearance and delivery.

The HS (Harmonized System) code for conveyors generally falls under Chapter 84, which encompasses machinery and mechanical appliances. Conveyors are typically classified under subheading 8428, which pertains to “Other lifting, handling, loading or unloading machinery (for example, lifts, escalators, conveyors, teleferics).” More specifically, conveyors are often categorized under the code 8428.90, which includes various types of conveyors and conveying equipment. Accurate classification of conveyors using the correct HS code is crucial for ensuring compliance with international trade regulations, determining applicable tariffs and duties, and facilitating smooth customs clearance processes. This classification helps businesses avoid legal issues, delays, and potential penalties associated with misclassification. Properly identifying the HS code for conveyors also supports efficient and cost-effective cross-border trade, contributing to streamlined logistics and operational efficiency in global markets.

Last Updated on June 26, 2024 by Jordan Smith

Jordan Smith, a seasoned professional with over 20 years of experience in the conveyor system industry. Jordan’s expertise lies in providing comprehensive solutions for conveyor rollers, belts, and accessories, catering to a wide range of industrial needs. From initial design and configuration to installation and meticulous troubleshooting, Jordan is adept at handling all aspects of conveyor system management. Whether you’re looking to upgrade your production line with efficient conveyor belts, require custom conveyor rollers for specific operations, or need expert advice on selecting the right conveyor accessories for your facility, Jordan is your reliable consultant. For any inquiries or assistance with conveyor system optimization, Jordan is available to share his wealth of knowledge and experience. Feel free to reach out at any time for professional guidance on all matters related to conveyor rollers, belts, and accessories.